ARE DIGITAL BANK CRISES FREE, LET’S KNOW THE TRUTH!

The financial landscape has evolved significantly in recent years, with digital banking emerging as a game-changer. As more people worldwide are turning to digital banking solutions for their financial needs, it’s essential to understand the benefits and drawbacks associated with this growing trend. In this detailed blog, we will delve into the world of digital banking and explore its various aspects, highlighting the pros and cons for consumers and businesses alike.

1. What is Digital Banking?

Digital banking, also known as online or virtual banking, refers to the provision of banking services through digital channels, such as mobile apps, websites, and other online platforms. These services allow users to perform a wide range of banking activities, including account management, fund transfers, bill payments, and applying for loans or credit cards, without visiting a physical bank branch.

2. The Pros of Digital Banking

(A). Enhanced Security

Digital banks employ robust security measures to protect customers’ data and financial transactions. These measures include encryption, secure socket layers (SSL), multi-factor authentication, and regular security updates to guard against cyber threats.

(B). Convenience and Accessibility

One of the most significant advantages of digital banking is the convenience it offers. Users can access their accounts and perform banking transactions anytime, anywhere, using their smartphones, tablets, or computers. This 24/7 accessibility eliminates the need to visit a bank branch during specific hours or wait in long queues, making banking more efficient and user-friendly.

(C). Lower Fees and Competitive

Rates Digital banks often have lower operating costs compared to traditional banks, as they don’t need to maintain physical branches and employ large numbers of staff. These cost savings are often passed on to customers in the form of lower fees, higher interest rates on savings accounts, and more competitive loan and credit card offers.

(D). Advanced Features and Functionality

Digital banks typically invest heavily in technology, which allows them to offer advanced features and functionality not always available with traditional banks. Examples include real-time account updates, instant fund transfers, budgeting and financial management tools, and biometric security features, such as fingerprint or facial recognition.

(E). Eco-Friendly Banking

By eliminating the need for physical branches and paper-based transactions, digital banking contributes to a more sustainable and eco-friendly banking experience. This aspect is particularly appealing to environmentally conscious consumers.

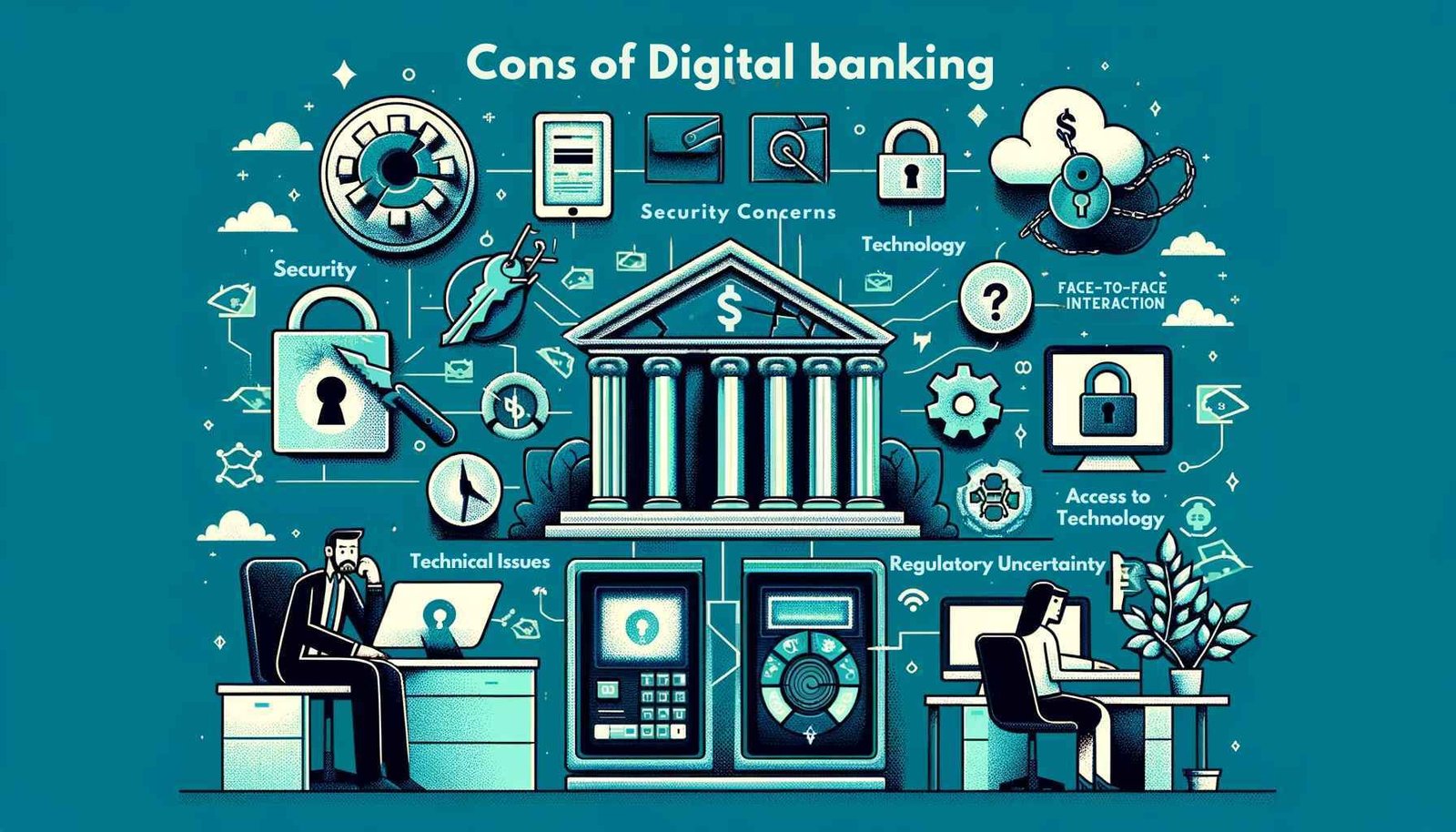

3. The Cons of Digital Banking

(A). Limited Face-to-Face Interaction

One of the main drawbacks of digital banking is the lack of face-to-face interaction with banking professionals. While many digital banks offer customer support through chat, email, or phone, some customers may miss the personalized service and relationship-building opportunities that come with in-person banking.

(B). Digital Literacy and Access to Technology

Digital banking requires a certain level of digital literacy and access to technology, such as smartphones, tablets, or computers with internet connectivity. This may be a barrier for some individuals, particularly older adults or those living in areas with limited internet access.

(C). Security Concerns

While digital banks employ robust security measures, the risk of cyberattacks and data breaches is ever-present. Users must remain vigilant in protecting their personal information and be aware of potential phishing scams and other online threats.

(D). Reliability and Technical Issues

Digital banking platforms may experience technical issues or downtime, which can temporarily disrupt users’ access to their accounts and banking services. In such cases, customers may need to rely on customer support or alternative banking channels to resolve their issues.

(E). Regulatory Uncertainty

As digital banking continues to evolve, there may be regulatory uncertainty surrounding certain aspects of the industry, such as licensing requirements and consumer protection laws. This can affect the stability and growth of digital banks and their services.

Digital banking has transformed the way people manage their finances, offering increased convenience, lower fees, and innovative features. However, it’s essential to be aware of the potential drawbacks, such as limited face-to-face interaction, digital literacy requirements, security concerns, and occasional technical issues.

To make the most of digital banking, users should carefully evaluate their needs, preferences, and risk tolerance. By choosing a reputable digital bank with strong security measures and responsive customer support, consumers and businesses alike can enjoy the many benefits of digital banking while minimizing potential downsides.

As digital banking continues to grow and evolve, it’s likely that we’ll see further advancements in technology and regulatory frameworks that will shape the industry’s future. By staying informed about these developments, users can make informed decisions about their banking choices and fully leverage the potential of digital banking to achieve their financial goals.

Here are some frequently asked questions (FAQs) related to digital banking and its pros and cons:

(A). Is digital banking safe?

Digital banking is generally safe, as banks employ robust security measures, such as encryption, secure socket layers (SSL), multi-factor authentication, and regular security updates. However, users must remain vigilant in protecting their personal information and be aware of potential phishing scams and other online threats.

(B). Can I perform all banking transactions through digital banking?

Most digital banks offer a wide range of banking services, such as account management, fund transfers, bill payments, and applying for loans or credit cards. However, some transactions or services, like depositing cash or obtaining certified checks, may still require a visit to a physical branch or ATM.

(C). What if I need help or have an issue with my digital bank account?

Most digital banks offer customer support through various channels, such as live chat, email, or phone. In case of any issues or questions, you can reach out to their customer support team for assistance.

(D). Do digital banks offer the same financial products as traditional banks?

Digital banks generally offer a similar range of financial products as traditional banks, including checking and savings accounts, loans, and credit cards. However, some digital banks may specialize in specific financial products or cater to particular customer segments, so it’s essential to compare offerings to find the best fit for your needs.

(E). Are digital banks FDIC insured?

In the United States, many digital banks are FDIC-insured, which means that customer deposits are protected up to $250,000 per depositor in case the bank fails. Before opening an account with a digital bank, it’s essential to verify its FDIC-insured status to ensure the safety of your deposits.

(F). How do I open a digital bank account?

Opening a digital bank account usually involves visiting the bank’s website or downloading its mobile app and following the account-opening process. You’ll typically need to provide personal information, such as your name, date of birth, Social Security number, and a valid form of identification. Some digital banks may also require you to make an initial deposit to open an account.

(G). Can I use digital banking if I live outside the country where the bank is located?

Some digital banks allow customers to open and manage accounts even if they reside outside the bank’s home country. However, this may vary depending on the specific bank and the regulations governing cross-border banking services. It’s important to research and confirm the availability of digital banking services for your location before opening an account.